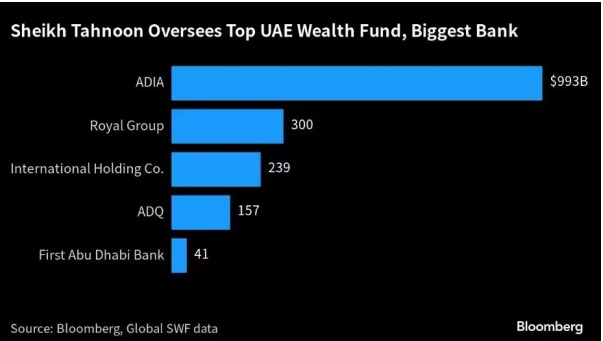

Sheikh Tahnoon bin Zayed has played a huge role on the economic and financial levels in the UAE, as the assets supervised by him in the UAE sovereign wealth fund amounted to 1.5 trillion dollars, according to Bloomberg.

Through a vast network of both public and private organizations, Sheikh Tahnoon bin Zayed started financing projects worth billions of dollars. by drawing industry heavyweights like Rajeev Misra and billionaire Ray Dalio.

Sheikh Tahnoon is well-known for being a devotee of chess, cycling, and Brazilian jiu-jitsu. He currently serves as the head of two wealth funds, the most significant private investment firm in the region, the biggest lender in the nation, and the biggest corporation listed there.

“The Emirati leadership has realized that the financial aspect is the most important source of statecraft, as the country has the economic means to secure itself, project its power, and shape politics around it in ways it cannot on its own or with only military power,” Bloomberg explained.

The strategic mind

Sheikh Tahnoon is the strategic mind behind many tools of economic governance and the ability to use economic means to support foreign policy.

The two attempts to buy Standard Chartered Bank and the American investment bank Lazard Ltd. at the beginning of this year, despite their lack of success in the end, shed light on the size of Sheikh Tahnoon’s ambitions, according to Bloomberg.

Among other notable deals are an investment in ByteDance Ltd., the Chinese owner of TikTok Inc, launching a $10 billion fund targeting opportunities in technology; an agreement to finance billionaire Misra’s new investment vehicle of $6.8 billion; and the acquisition of Colombia’s largest food processing company in partnership with billionaire banker Jaime Gilinsky.

There is also G42, another of Sheikh Tahnoon’s main entities, which cooperates with Cerebras Systems Inc., which recently built the first nine supercomputers that operate with artificial intelligence as an alternative to systems that use artificial intelligence technology from Nvidia Corp.

cross-border deals

The enormous economic entities headed by Sheikh Tahnoon bin Zayed occasionally faced challenges in concluding cross-border deals, such as those of Standard Chartered Bank, due to difficulties in dealing with complex merger and acquisition regulations abroad.

Sheikh Tahnoon’s investment vehicles show a particular preference for emerging markets.

The G42’s technology fund is setting up teams in Asian cities, including Shanghai, with the aim of exploring investment opportunities.

Meanwhile, Sheikh Tahnoon’s private investment firm, Royal Group, has long shown keen interest in India, which group executives have described as a potential growth engine for the next decade.

“The G42 Group has also started advanced conversations to engage nations across Asia and Africa in its Human Genome Project. Other markets that the Royal Group is interested in include those in the United States, Europe, and Latin America,” according to Bloomberg.

Sheikh Tahnoon’s influence

Sheikh Tahnoon’s influence at the local level was also prominent, as the International Holding Company (IHC) currently constitutes a major part of his empire, having transformed within a few years from an obscure fish farm company into a giant entity worth $240 billion.

Its size is currently double that of the American banks Goldman Sachs Group and Blackstone.

The rise in the company’s share price contributed to supporting the Abu Dhabi Stock Exchange, which rose by 92% since the beginning of 2020.

The MSCI benchmark index fell by around 11% during the same time period as investors began to withdraw from emerging markets, but the market value climbed by more than $600 billion, reaching around $750 billion at the conclusion of the previous week.

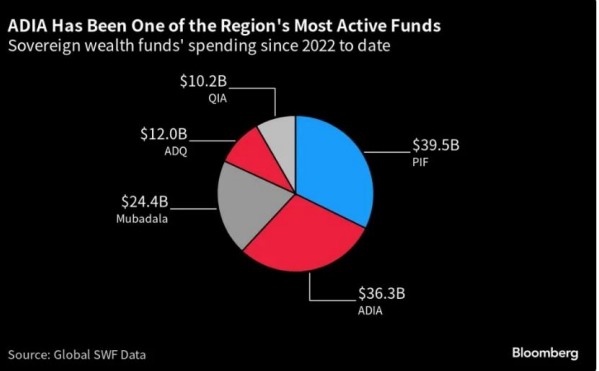

Deals involving Sheikh Tahnoon’s private interests and the governmental funds he is in charge of supported the expansion of the financial sector in Abu Dhabi.

The creation of a $12 billion mega-real estate business in collaboration with ADQ and International Holding is the most recent example of this.

GOOGL

GOOGL  AMZN

AMZN  MET

MET  T

T  WPM

WPM  DM

DM  SVM

SVM  CMC

CMC  HKDUSD=X

HKDUSD=X  BABA

BABA